23+ mortgage rate buy down

Web Mortgage rate buy-downs give buyers peace of mind knowing they have done everything in their power to lower the cost of their monthly payments for the full term of the loan. Web The calculation used to buy down the rate may also differ among lenders but is usually about equal to what the borrower saves in interest.

Compare Current Mortgage Rates Interest Com

A mortgage point typically costs around 1 of your mortgage loan amount.

. With a 2-1. Web We offer five types of Temporary Buydowns through Rate Reduce. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi.

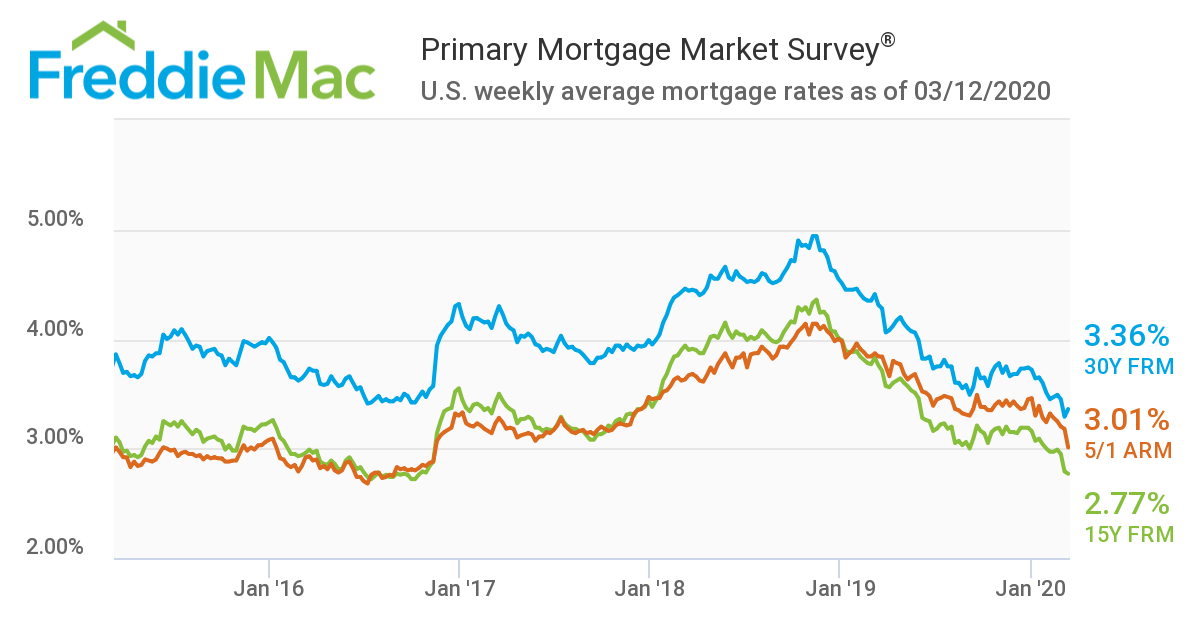

Heres How to Simplify Your Search For a Great Mortgage Rate. Heres How to Simplify Your Search For a Great Mortgage Rate. The average 30-year fixed mortgage interest rate is 708 which is an increase of 7 basis points from one week ago.

The most common is called a 2-1 buydown but theres also a 3-2-1 buydown 1-1-1 buydown 1-0 buydown and 15-05 buydown. Web 1 day agoBecause of all this SVB now wants to raise 225 billion of fresh capital which includes 125 billion of common stock a 500 million private placement from the private equity firm General. Additionally the current national average 15-year fixed mortgage rate increased 4 basis points from 5.

A basis point is equivalent to 001. The 30-year fixed mortgage rate on March 1 2023 is up 15 basis points from the previous weeks average rate of 653. Ad Start Using Our Online Mortgage Calculators To Calculate Your Monthly Payment.

Web A mortgage rate buydown which is often called a buydown mortgage for short is a financing arrangement that gives a borrower a lower rate for a certain number of years or for the life of the loan. As an example using the average mortgage. Easily Compare Mortgage Rates and Find a Great Lender.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Otherwise known as buying mortgage points or discount points. They all offer a period of time with a lower rate and work similarly.

Web The buyer will pay an interest rate of 5 in the third year. Review the chart below to see how a 3-2-1 mortgage buydown would impact the buyers monthly mortgage payment on a 400000 30-year loan with an interest rate of 6. This is not a commitment to lend nor a preapproval.

Results are hypothetical and may not be accurate. The 30-year fixed-rate mortgage is the most common type of home loan. Web Total cost to buy down rate to 5875.

Web The 30-year fixed-rate mortgage averaged 65 for the week ending February 23 up from 632 the week prior according to Freddie Mac. 3-2-1 Buydown In a 3-2-1 buydown the buyer pays lower payments on the loan for the first three years. The borrower pays mortgage points at closing to cover the difference between the standard rate and the lowered rate.

Despite these increases many housing market watchers. Web 1 day agoFor a 30-year fixed-rate mortgage the average rate youll pay is 713 which is a growth of 7 basis points compared to one week ago. Web What does buying down the mortgage rate mean.

Web Common temporary buydown terms are 2-1 and 1-0 where the first number is the rate reduction you receive in the first year and the second number is the rate reduction for year two. Check Official Requirements See If You Qualify for a 0 Down VA Home Loan. Ad 1st Time Home Buyers.

Web The current average 30-year fixed mortgage rate climbed 5 basis points from 663 to 668 on Wednesday Zillow announced. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Web Mortgage interest rates Todays 30-year mortgage rate advances 018 The average 30-year fixed-mortgage rate is 695 percent up 18 basis points since the same time last week.

How does a buydown. Compare Current Mortgage Rates. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Youll notice that their names correspond with the periods of lower ratesso a 3-2-1. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late.

Web Buydown Fee of Loan Amount calculate Total buy down fee for this loan is 11464 5000 is paid by a third-party and 6464 is paid by you. First Time Home Buyer. Web A 3-2-1 and 2-1 mortgage buydown are two common structures lenders can use.

A basis point is equivalent to 001 Thirty. From years 4-30 the buyer will pay the full 6 unless they decide to sell or refinance. Web On a 30-year jumbo mortgage the average rate is 722 with an APR of 723.

Ad 1st Time Home Buyers. Web 30-year fixed-rate mortgages. Ad Find The Best Options for Buying a Home.

The rate is typically two. The average rate on a 51 ARM is 578 with an APR of 772. Consult a financial professional for full details.

300000 It would take roughly 33 months to realize the savings associated with the lower rate of 5875 factoring in potential tax deductions and savings accounts yields. This is an increase from the previous week. First Time Home Buyer.

The process of buying down your mortgage rate involves paying an extra upfront fee to your lender at closing to secure a lower interest rate and monthly payment for the entire length of your mortgage. Web Simply put a mortgage rate buy-down is upfront money often paid by the home seller builders and lenders can also front the cost to buy down the interest rate on the buyers. Web You can do a buydown by purchasing mortgage points sometimes called discount points on your loan at closing.

Ad See what your estimated monthly payment would be with the VA Loan. In short locking in your rate now will save you money over time and that is a huge benefit to new homeowners. Easily Compare Mortgage Rates and Find a Great Lender.

Save Money With Lowest Rates 2023. Web 15 hours agoThe current average 30-year fixed mortgage rate is 673 according to Freddie Mac. Compare Top Mortgage Lenders 2023.

Web A 2-1 buydown is a type of financing that lowers the interest rate on a mortgage for the first two years before it rises to the regular permanent rate.

How Does Mortgage Rate Buydown Work The Washington Post

Should I Pay Off My Mortgage Early Or Invest Extra Wealth Mode Financial Planning

What Is A Buydown Interest Rate Moneytips

Current Mortgage Rates Average Us Daily Interest Rate Trends For Fha Home Loans Prime Other Mortgages

Mortgage Buydowns Are Making A Comeback As Interest Rates Remain High

Should I Pay Off My Mortgage Early Or Invest Extra Wealth Mode Financial Planning

Mortgage Rates Tumble As Lenders Face Increasing Difficulties The Washington Post

P0vcm8nnmgkhem

Most Homebuyers Forking Out Big Bucks To Buy Down Mortgage Rate Inman

The Buying Power Of Lower Mortgage Rates The New York Times

Lower Mortgage Rates No Relief For Us Home Sales Wolf Street

Top Mortgage Lender For Refinancing Or New Loans

Mortgage Rates Have Moved Higher Off Of Record Lows For The Second Consecutive Week Tamra Wade Team Re Max Tru

2 High Yield Sleep Well At Night Dividend Aristocrats For This Volatile Market Seeking Alpha

John Holt Johnholtfinance Twitter

Most Homebuyers Forking Out Big Bucks To Buy Down Mortgage Rate Inman

What Is A Mortgage Rate And How Do They Work Credible